The Nashville City of Tennessee:

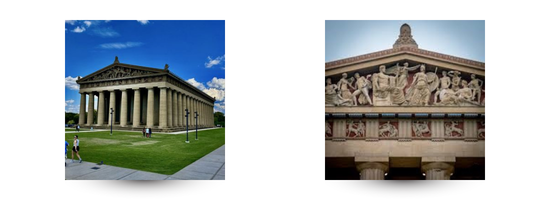

Nashville is the most populous city in the state of Tennessee. It is also the capital of Tennessee. It is the seat of Davidson County in Middle Tennessee, located on the Cumberland River. Nashville is the 35th-largest metropolitan area in the country. The Parthenon in Centennial Park, Nashville, Tennessee, United States, is a full-scale replica of the original Parthenon in Athens, Greece. It was designed by architect William Crawford Smith.

The population of this city is 689,400 at the 2020 census. Residents and also hosts a diverse business community, including small business owners, real estate professionals, medical practitioners and service providers. However, many of these professionals often face challenges related to tax compliance, back taxes, IRS audits, penalties, and complex accounting needs. Here World Tax and Accounting offer their services as a valuable partner and provide professional tax resolution service.

Professional Tax Services for IRS Relief in Nashville

World Tax and Accounting provides comprehensive solutions for individuals and businesses seeking relief from IRS challenges in Nashville. Our tax consultant team delivers customized strategies to address back taxes, audits, and collection actions with confidence. By merging professional accounting and tax services, we ensure accuracy, compliance, and long-term financial stability for our clients. We provide best results as a trusted tax accountant, the team of World Tax and Accounting offers effective tax relief services designed to reduce liabilities, resolve disputes, and protect your financial interests while guiding you toward lasting peace of mind.

Tax Services with Tax Preparation, Filing and Representation

World Tax and Accounting always offers reliable tax service, our tax resolution services designed to meet the needs of businesses and individuals alike. The business tax consultant of our team works closely with clients to develop effective tax planning services that reduce risk and improve compliance. Our expert team provides accurate tax preparation and timely tax filing to ensure all returns are completed correctly and submitted on time. Whenever any businessman or an individual faces issues with the IRS, our professional Tax Representation services protect your interests and handle communications on your behalf, giving you confidence and peace of mind throughout the tax process.

Quality Accounting Services in Nashville

World Tax and Accounting has the ability to deliver top quality solutions to individuals and businesses to resolve complex financial and tax-related challenges in Nashville. Our accounting services are designed to identify issues, correct discrepancies, and restore financial accuracy. By merging expert accounting and tax services, we proudly deliver compliance and long-term financial stability.

World Tax and Accounting also offers quality and reliable accounting services for small businesses, ensuring each client receives personalized attention. Through client accounting services, we help businesses regain control of their finances and move forward with confidence.

Professional Bookkeeping Services for Financial Growths in Nashville

Bookkeeping services of World Tax and Accounting are designed to support financial accuracy, compliance, and sustainable business growth in Nashville. Our specialized team of local bookkeeping services has the ability to deliver the results with maintained organized records, track expenses, and monitor cash flow effectively. Our professional bookkeeping services are assigned to meet the needs of growing companies. A reliable team ensures timely reporting and clear financial insights.

The professional team also provides bookkeeping services for small businesses, our services allow owners to focus on operations while we manage the financial details with precision.

CFO Services in Nashville for Achieving Long-Term Financial Success

CFO Services of World Tax and Accounting are designed for businesses in Nashville, who want to achieve long-term financial success through strategic planning and expert financial oversight. Our CFO services provide clear insights into budgeting, forecasting, and cash flow management, empowering business owners to make informed decisions. We are one of the best CFO services providers in Nashville, our team of CFO services works with the Chief Executive Officer and management to strengthen financial performance and support sustainable growth.

Our special CFO services for startups, helping new businesses build strong financial foundations, manage risks, and scale confidently in a competitive market.

Fractional CFO: Services That Help Businesses Achieve Financial Success

Fractional CFO Services of World Tax and Accounting provide businesses with high-level financial leadership without the cost of a full-time executive. Our temporary CFO services are for those companies, who are facing problems like growth phases, or complex financial challenges. Our trusted part time CFO services give business owners strategic guidance on cash flow, forecasting, and profitability when they need it most. Specially for emerging companies, our expert fractional CFO for startups helps establish strong financial systems, manage investor expectations, and create a clear roadmap for sustainable financial success.

Why Choose World Tax and Accounting in Nashville, TN?

World Tax and Accounting stands out for delivering trusted IRS tax relief and personalized tax resolution services. Now we will explain why clients choose us to help them with confidence.

Nashville’s Local Tax Law Experts: Because of being local experts of Tennessee, the team understands Nashville-specific regulations and provides effective tax resolution services tailored to local and federal requirements.

Experienced IRS Specialists: Our CPAs and enrolled agents are seasoned tax resolution specialists with extensive experience dealing directly with the IRS. They know exactly how to negotiate on your behalf and secure the IRS tax relief you need.

Customized Tax Solutions Services: Every case is unique, there are no one-size-fits-all solutions. We create customized strategies designed to help you settle tax debt and resolve complex tax issues efficiently. Whether you need tax planning services in Nashville or tax resolution services, every plan is based on your financial situation.

Comprehensive Tax Services: We offer a full range of financial and tax services in Nashville under one roof, including tax preparation, bookkeeping, business consulting, CFO services, and IRS representation. From managing your books to defending you before the IRS, we handle everything needed for effective tax resolution.

Honest Pricing with Transparency: No hidden fees. We provide honest, upfront pricing with clear communication and trustworthy service every step of the way.

Fast Response and Proactive Support: We provide fast IRS tax relief to help you regain control of your financial future before the IRS takes action. Our team moves quickly to stop enforcement, levies, and garnishments.

Our Team in Nashville TN, Fixes All IRS Issues Every Day:

Solving IRS Problems yourself is not an easy task, these problems can even increase if you try to do it yourself. Kind of problems like receiving a notice, missing a filing, or haven’t paid taxes in years, the stress builds quickly, World Tax and Accounting has the ability to solve these, we offer professional tax services in Nashville and we specialize in solving complex IRS problems every day. We don’t use scare tactics, rather our local experts who understand the IRS and know how to protect what matters to you. If you understand you are facing these types of issues alone, it is not like that. Thousands of people across Nashville are struggling with IRS problems, unpaid taxes, audits, wage garnishments, tax liens, and more.

With World Tax & Accounting, you will not have to face IRS problems alone, whether you are contractor, retirees, parents, or small business owners, we will help to Nashville residents regain control of their finances and resolve even the toughest tax situations, and finally you will see that we will take you to a safe zone.

Industries We Proudly Serve in Nashville, Tennessee

We work with a variety of clients in Nashville TN, offering tailored services by industry to better support your business and compliance goals.

- Real Estate: Property owners, brokers, and realtors benefit from strategic tax planning and compliance services.

- Construction: Specialized bookkeeping and payroll solutions for contractors and builders.

- Healthcare: Tax optimization, compliance and bookkeeping services for doctors, clinics, and healthcare providers.

- Law Firms: Full-service accounting and/or tax services for law firms, including solo attorneys and multi-partner practices.

- Financial Services: Customized CFO and CPA financial advisory services for advisory firms and agencies.

- Entertainment: Income management and IRS guidance for actors, performers, and entertainers.

- Freelancers: Tax prep and tracking for consultants, designers, and self-employed professionals.

- Insurance Agencies: Compliance services and tax filing for independent insurance businesses.

- Architects & Designers: Industry-specific guidance for managing project-based income and deductions.

Get Professional Help with Nashville, TN —Schedule a Free Consultation Today