The Hoboken City of New Jersey

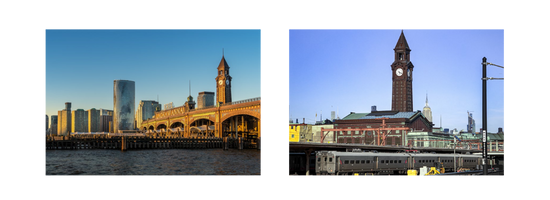

Hoboken is one of the famous cities of the state of New Jersey, it is located in Hudson County along the Hudson River, directly across from Manhattan, New York City. Hoboken was originally settled in the early 19th century and was incorporated as a city in 1855. Hoboken city is famous for its vibrant waterfront, historic buildings, and strong urban community. Hudson River Waterfront Walkway, Pier A Park, Stevens Institute of Technology, and Sinatra Park are some of the most famous and historic landmarks in Hoboken, New Jersey.

Hoboken, New Jersey is home to a population of around 60,000 residents and also hosts a diverse business community, including small business owners, real estate professionals, medical practitioners, and service providers. However, many of these professionals often face challenges related to tax compliance, back taxes, IRS audits, penalties, and complex accounting needs. In these critical situations, World Tax and Accounting steps in as a valuable partner. As a trusted tax resolution service provider, World Tax and Accounting helps Hoboken’s business owners by offering.

Professional Accounting & Tax Services in Hoboken, NJ

World Tax and Accounting provides professional accounting, bookkeeping, and tax services to individuals, startups, and businesses in Hoboken, New Jersey, and nearby areas including Jersey City. We have years of experience and a client-focused approach, our expert team delivers reliable financial solutions designed to help businesses grow, stay compliant, and remain financially strong.

From a startup, a small business owner, or an individual taxpayer, our professional team offers personalized accounting services, accurate tax preparation, and advanced financial guidance tailored to your needs.

Extensive Accounting and Bookkeeping Services in Hoboken, NJ

If you are a businessman, you would know very well that managing finances can be challenging without expert support. World Tax and Accounting offers complete bookkeeping services and accounting solutions to help businesses maintain accurate records and make informed decisions. Our Major services include monthly, financial statement preparation, payroll processing, expense tracking with reconciliation and cash flow management.

We proudly serve businesses looking for reliable bookkeeping in New Jersey and professional support from experienced accountants in Hoboken NJ. Our goal is to keep your finances organized so you can focus on running your business.

Tax Preparation and Tax Accounting Services

To avoid penalties and unnecessary stress you need to file accurate and timely tax. World Tax and Accounting provides expert tax services for individuals and businesses, including:

- Federal and state tax preparation

- Business and self-employed tax filings

- Multi-state tax compliance

- Year-round tax planning

If you are searching for a reliable tax accountant Hoboken NJ or professional tax preparation Jersey City, our experts ensure every return is prepared accurately and in full compliance with tax laws. Our team also assists clients across the region who need support from knowledgeable accountants in Jersey City NJ.

Hoboken Tax Resolution & IRS Support

Sometimes you can Face IRS notices, back taxes, or enforcement actions. It can be a reason for stress. The team of World Tax and Accounting offers professional tax resolution service solutions to help you regain financial stability. Our IRS-related services include:

- Back tax filing and compliance

- Installment agreements

- Wage garnishment and levy assistance

- Penalty abatement

- Negotiation with tax authorities

Our professional team has the ability to provide proven IRS tax relief solutions and work directly with the IRS on your behalf to reduce stress and protect your income. If you’re dealing with IRS enforcement actions and want to understand your rights before things escalate, check out our article: “9 Taxpayer Rights When Dealing with the IRS”.

Startup Accounting and Bookkeeping Services

Starting any business requires more than a great idea, it requires strong financial foundations. World Tax and Accounting specialize in startup bookkeeping, bookkeeping for startups, and complete accounting for startups to help new businesses succeed from day one. Our startup-focused services include:

- Business entity selection guidance

- Financial system setup

- Ongoing bookkeeping

- Tax compliance and planning

- Growth-focused financial reporting

As one of the reliable accounting firms for startups, our experts also offer business startup accounting and bookkeeping services designed to scale as your company grows. Choosing the right business structure early can prevent costly tax issues later. If you want a deeper breakdown, check out our guide: “How to Choose the Perfect Business Entity for Your Venture”.

CFO Services for Small Businesses

Strategic financial leadership plays a crucial role for sustainable growth. World Tax and Accounting offers flexible CFO services for small businesses that need expert guidance without the cost of a full-time CFO. Our CFO services for small business include:

- Budgeting and forecasting

- Cash flow analysis

- Profitability improvement

- Financial strategy and planning

- Investor and lender support

These services are best for growing businesses seeking experienced financial oversight from reputable accounting firms in NJ.

Proudly Serving Hoboken, Jersey City, and Surrounding Areas

We are serving not only Hoboken, we also support clients across Hudson County and beyond. Our experts work with individuals and businesses seeking:

- Trusted tax accountant Jersey City

- Professional support for Hoboken taxes

- Expert guidance from experienced tax accountant Hoboken

- Full-service solutions from trusted accountants in Hoboken NJ

There is no issue that what is the size of your industry or business, our team delivers personalized financial solutions with accuracy and care.

Why Choose World Tax and Accounting in Hoboken, NJ?

Most of the clients prefer World Tax and Accounting in Hoboken, NJ, because we offer for the people of Hoboken:

- Experienced tax and accounting professionals

- Personalized financial solutions

- Transparent communication

- Proactive tax planning

- Reliable year-round support

Including daily bookkeeping to advanced financial strategy, we are one of the trusted accounting firms in NJ committed to your success.

The IRS Experts Hoboken Residents Trust Most

When the IRS starts closing in, you need more than advice, you need answers. At World Tax and Accounting, we help people across Hoboken face serious IRS problems with real strategies and real results.

Whether you’re behind on taxes, facing an audit, or dealing with wage garnishments, we’ve seen it and we’ve solved it. No scare tactics. No false promises. Just experienced professionals who care about helping you move forward.

IRS Problems in Hoboken? You’re Not Alone

IRS problems don’t just affect people with complicated finances. We help teachers, freelancers, retirees, business owners, and families. The common thread? They got stuck and needed a way out.

Maybe you missed a few tax deadlines. Maybe you owe more than you can pay. Maybe the IRS thinks you made a mistake and now they want proof you didn’t. No matter the situation, one thing is clear: waiting makes it worse.

That’s where we come in. At World Tax and Accounting, we act fast to assess your case, explain your options, and stop the pressure before it spirals.

IRS Problems? These Are the Ones We Handle Best

At World Tax and Accounting, we help people across Hoboken take control of their tax situations every day. Whether you’re behind on filings or facing aggressive IRS action, we deliver real solutions that get results.

1. Behind on Filing? We’ll Help You Catch Up Without the Stress

Unfiled Tax Returns

If you’ve missed tax deadlines, you’re not alone and you’re not stuck. We help clients file years of back taxes quickly and correctly. No lectures, no fear tactics just a straightforward plan to get current and stay that way.

2. Facing an Audit? Let Us Step In and Take the Lead

Audit Representation

IRS audits are serious but they don’t have to be overwhelming. Our experienced professionals represent you from start to finish, handling all correspondence and defending your interests with facts, not guesswork.

3. Drowning in IRS Debt? There’s a Way Forward

Back Taxes

Owe more than you can afford? Don’t wait. We assess your full financial picture to pursue relief options like Offers in Compromise or structured payment plans. We’ve helped countless clients reduce or resolve major tax debt.

4. IRS Threatening to Seize Assets? We Act Fast

Tax Liens and Asset Seizures

If your home, business, or bank accounts are at risk, time is critical. We step in immediately to negotiate with the IRS, stop seizures when possible, and work toward a manageable resolution that protects what matters most.

5. Struggling With Payroll Tax Problems? We’ve Got Your Back

Delinquent Payroll Taxes

Business owners juggling overdue payroll taxes face penalties that escalate quickly. We provide practical, strategic support to resolve payroll issues and prevent further action from the IRS or state authorities.

6. Losing Your Paycheck to the IRS? Let’s Put a Stop to It

Wage Garnishments and Bank Levies

If the IRS is taking money from your paycheck or freezing your account, we’ll fight to get that money back. We handle levy release requests, negotiate payment terms, and help you rebuild financial peace of mind.

Get Help From Hoboken’s Most Trusted IRS Tax Team

There’s no such thing as a small IRS problem. If you’re getting letters, phone calls, or warnings, now is the time to act. We’ve helped thousands of clients across the region turn things around and we can do the same for you.

Contact us today at (551) 525-1693 to schedule your free consultation with World Tax and Accounting. We’re the IRS experts Hoboken, NJ residents trust most because we know how to fix what others can’t.